Delving into the world of stock buyback programs, this introduction aims to provide a comprehensive overview of this financial strategy that companies often utilize to enhance shareholder value.

As we navigate through the details of how stock buyback programs function and their impact on companies and investors, we uncover the intricacies of this widely discussed topic.

Overview of Stock Buyback Programs

:max_bytes(150000):strip_icc()/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)

Stock buyback programs, also known as share repurchase programs, are initiatives undertaken by publicly traded companies to buy back their own shares from the open market. This process involves a company purchasing a portion of its outstanding shares, reducing the total number of shares available in the market.

Examples of Companies with Stock Buyback Programs

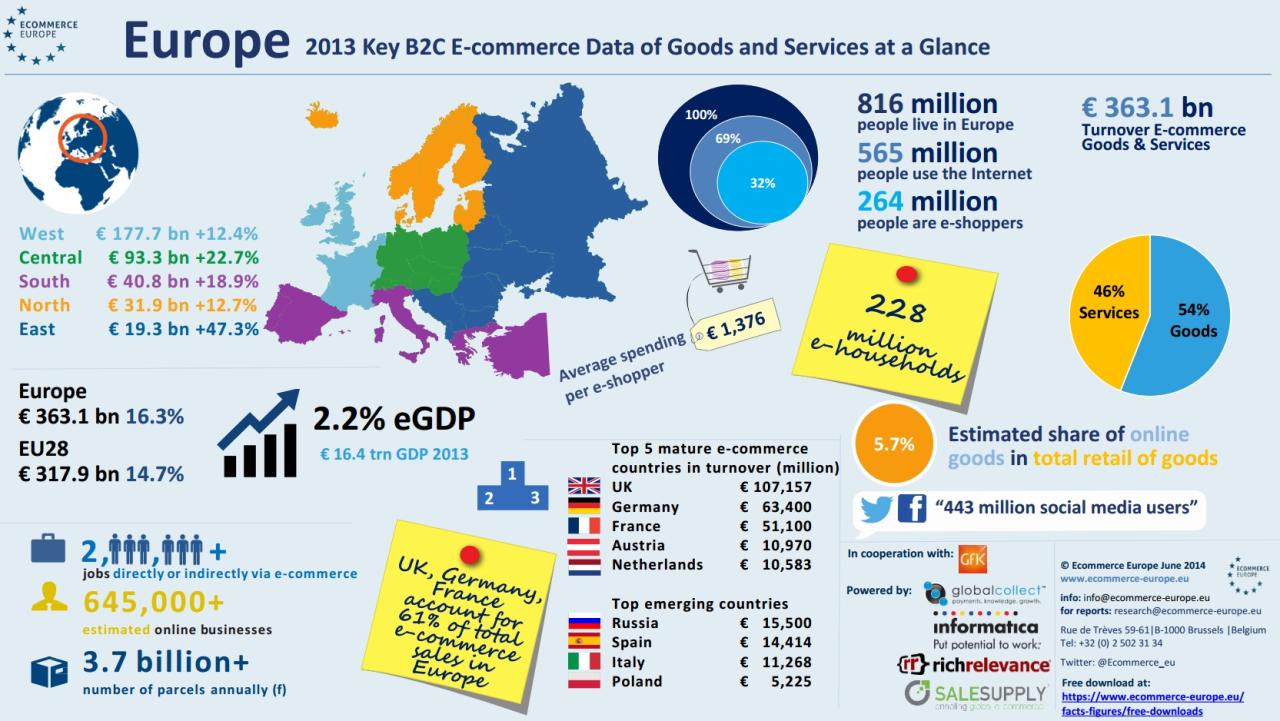

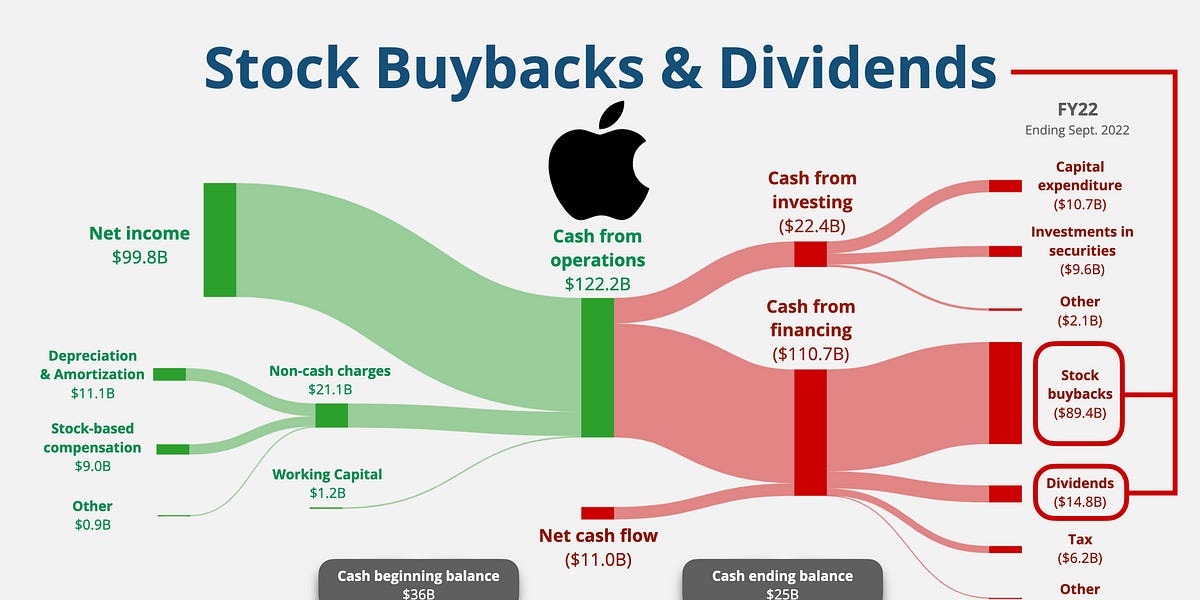

- Apple Inc. - Apple has a history of implementing stock buyback programs to return excess cash to shareholders and boost earnings per share.

- Microsoft Corporation - Microsoft has utilized stock buybacks as part of its capital allocation strategy to enhance shareholder value.

- Alphabet Inc. (Google) - Google has engaged in stock buyback programs to offset dilution from employee stock options and maintain shareholder returns.

Purpose and Benefits of Stock Buyback Programs

Stock buyback programs serve various purposes for companies, including:

- Increasing earnings per share by reducing the number of outstanding shares, making each remaining share more valuable.

- Providing a tax-efficient way to return excess cash to shareholders, as opposed to dividends.

- Supporting share price performance by signaling confidence in the company's financial health and future prospects.

Mechanics of Stock Buyback Programs

Stock buyback programs are a common strategy used by publicly traded companies to repurchase their own shares from the open market. This process involves the company buying back a portion of its outstanding shares, which reduces the total number of shares available in the market.

Stock Buybacks vs Dividends

When it comes to returning value to shareholders, companies have two main options: stock buybacks and dividends. While dividends involve distributing a portion of the company's profits to shareholders in cash, stock buybacks involve repurchasing shares from the market. Both methods aim to enhance shareholder value, but they do so in different ways.

- Stock Buybacks:

- By reducing the number of outstanding shares, stock buybacks can increase earnings per share (EPS) and potentially boost the stock price.

- Companies often use stock buybacks to signal to the market that they believe their stock is undervalued.

- Shareholders who retain their shares after a buyback may see an increase in their ownership percentage of the company.

- Dividends:

- Dividends provide a regular income stream for shareholders, especially those seeking income from their investments.

- Companies with a history of paying dividends can attract income-focused investors.

- Dividends are typically taxed at a different rate than capital gains from stock buybacks.

Execution of Stock Buyback Programs

Companies typically follow a step-by-step process to execute stock buyback programs:

- Authorization: The company's board of directors authorizes the buyback program, setting the maximum amount and duration.

- Market Research: The company may engage in market research to determine the best timing and price at which to repurchase shares.

- Trading: The company then buys back shares through open market purchases or tender offers.

- Retirement or Treasury Stock: The repurchased shares are either retired, reducing the total outstanding shares, or held as treasury stock for future use.

Impact of Stock Buyback Programs

Stock buyback programs can have a significant impact on a company's stock price and overall financial health. Let's delve into how these programs affect various aspects of a company and its investors.

Effect on Stock Price

Stock buyback programs often lead to an increase in a company's stock price. By reducing the number of outstanding shares in the market, the earnings per share (EPS) metric tends to improve, making the stock more attractive to investors. This increased demand can drive up the stock price over time.

Impact on Financial Statements

Stock buybacks impact a company's financial statements in several ways. First, the repurchase of shares reduces the amount of cash on hand, which could otherwise be used for investments or other strategic initiatives

Advantages and Disadvantages for Investors

For investors, stock buyback programs can be both advantageous and disadvantageous. On one hand, a higher stock price resulting from buybacks can lead to capital gains for shareholders who hold onto their shares. It also indicates that the company believes its stock is undervalued.

However, some critics argue that companies should instead invest in growth opportunities or pay dividends to shareholders, rather than repurchasing their own stock.

Regulation and Controversies Surrounding Stock Buyback Programs

Stock buyback programs are subject to various regulations to ensure fair practices and protect investors. The Securities and Exchange Commission (SEC) in the United States, for example, has rules in place to govern the disclosure and execution of stock buybacks by publicly traded companies.

These regulations aim to prevent market manipulation and insider trading, promoting transparency and accountability in the process.

Regulations Governing Stock Buyback Programs

- Companies must disclose their buyback plans to the public, including the amount of shares to be repurchased and the timeframe for completion.

- Insider trading restrictions apply, preventing company insiders from trading based on non-public information about the buyback.

- Buybacks must be conducted in a manner that does not artificially inflate the stock price or mislead investors.

Common Criticisms and Controversies

- One common criticism of stock buybacks is that they prioritize short-term gains for shareholders over long-term investments in research, development, and employee compensation.

- Some argue that buybacks can be used to artificially boost earnings per share (EPS) and executive compensation, without creating real value for the company.

- There are concerns that companies may be engaging in buybacks to prop up their stock prices, benefiting insiders and large shareholders at the expense of smaller investors.

Ethical Considerations

- From an ethical perspective, the decision to allocate capital towards buybacks instead of investments in innovation or workforce development can raise questions about corporate priorities and social responsibility.

- Companies need to balance the interests of various stakeholders, including shareholders, employees, customers, and the broader community, when considering stock buyback programs.

- Ensuring that buybacks are conducted in a transparent and responsible manner is crucial to maintaining trust and credibility with investors and the public.

Final Review

In conclusion, stock buyback programs play a crucial role in shaping the financial landscape of companies, influencing their stock prices, and presenting both advantages and disadvantages to investors. By understanding the mechanics and implications of these programs, stakeholders can make informed decisions in the realm of investments.

Clarifying Questions

What are the benefits of stock buyback programs for companies?

Stock buyback programs can help companies signal that they believe their stock is undervalued, potentially boosting investor confidence and increasing earnings per share.

How do stock buyback programs affect a company's financial statements?

Stock buybacks can impact financial metrics like earnings per share, return on equity, and leverage ratios, influencing how investors perceive the company's financial health.

What are some common criticisms of stock buyback programs?

One common criticism is that stock buybacks can artificially inflate stock prices, benefitting executives with stock-based compensation at the expense of long-term investments in the company.

Are there regulations governing stock buyback programs?

Yes, there are regulations set by the Securities and Exchange Commission (SEC) that companies must follow when engaging in stock buyback programs to ensure transparency and fair practices.

How do stock buybacks compare to dividends as a way to return value to shareholders?

While dividends provide regular income to shareholders, stock buybacks reduce the number of shares outstanding, potentially increasing the value of each remaining share.