Embark on a journey through the realm of financial analyst career paths, where opportunities and challenges intersect to shape a promising future. This engaging narrative delves into the intricacies of this dynamic field, offering a glimpse into what it takes to thrive as a financial analyst.

The role of financial analysts in the finance industry is crucial, requiring a unique blend of skills and qualifications. Let's explore the educational requirements, entry-level positions, career progression, and specializations that define this career path.

Overview of Financial Analyst Career Path

Financial analysts play a crucial role in the finance industry by providing valuable insights and recommendations to businesses and individuals regarding their financial decisions. They analyze financial data, market trends, and investment opportunities to help clients make informed choices.

Role of a Financial Analyst

Financial analysts are responsible for assessing the performance of stocks, bonds, and other investments to provide recommendations on buying, selling, or holding assets. They also evaluate the financial health of companies by analyzing financial statements, economic trends, and industry comparisons.

Typical Responsibilities of a Financial Analyst

- Conducting financial research and analysis to guide investment decisions.

- Preparing financial reports, forecasts, and models to assess the financial viability of projects.

- Monitoring financial news and market trends to stay informed about potential investment opportunities.

- Presenting findings and recommendations to clients, colleagues, and senior management.

- Assessing risk factors and making recommendations to minimize financial losses.

Skills and Qualifications Needed

- Strong analytical skills and attention to detail to interpret complex financial data accurately.

- Excellent communication and presentation skills to convey financial information clearly and effectively.

- Solid understanding of financial principles, accounting methods, and investment strategies.

- Proficiency in financial analysis software and tools to perform data analysis efficiently.

- A bachelor's degree in finance, accounting, economics, or a related field is typically required, with certifications such as Chartered Financial Analyst (CFA) considered advantageous.

Educational Requirements

To become a financial analyst, a strong educational background is essential. There are various educational paths that can lead to a career in this field, including degrees in finance, accounting, economics, or related fields.

Degree in Finance

A degree in finance provides a solid foundation in financial theory, investment analysis, and financial management. Students learn about financial markets, risk management, and corporate finance, which are crucial skills for a financial analyst.

Degree in Accounting

Accounting degrees focus on financial reporting, auditing, and taxation. While not as focused on financial analysis as a finance degree, accounting provides a strong understanding of financial statements and principles, which is valuable for a financial analyst.

Degree in Economics

An economics degree emphasizes economic theory, statistical analysis, and market trends. This background helps financial analysts understand the broader economic environment and its impact on financial markets and investment decisions.

Certifications such as CFA

The Chartered Financial Analyst (CFA) designation is highly respected in the finance industry. Earning a CFA charter demonstrates a deep understanding of investment analysis, portfolio management, and ethical standards. It can significantly enhance a financial analyst's career prospects and credibility in the field.

Entry-Level Positions and Internships

When starting a career as a financial analyst, aspiring professionals often begin by securing entry-level positions and internships to gain practical experience in the field.

Common Entry-Level Positions

- Financial Analyst Assistant: This role involves supporting senior financial analysts in conducting research, preparing reports, and analyzing financial data.

- Junior Financial Analyst: Junior analysts work on financial modeling, forecasting, and assisting in investment decisions under the guidance of more experienced analysts.

- Financial Research Analyst: Research analysts focus on collecting and analyzing data to provide insights on market trends, investment opportunities, and financial performance.

Significance of Internships

Internships play a crucial role in the development of aspiring financial analysts by offering hands-on experience and exposure to real-world financial practices. They provide an opportunity to apply theoretical knowledge in practical settings, build professional networks, and gain valuable insights into the industry.

Tips for Securing Internships and Entry-Level Positions

- Networking: Attend industry events, career fairs, and connect with professionals on platforms like LinkedIn to expand your network and increase your chances of finding opportunities.

- Develop Relevant Skills: Enhance your financial modeling, data analysis, and Excel skills to stand out to potential employers.

- Gain Certifications: Pursue certifications such as the Chartered Financial Analyst (CFA) designation to demonstrate your commitment and expertise in the field.

- Customize Your Resume: Tailor your resume to highlight relevant coursework, projects, internships, and skills that align with the requirements of the positions you are applying for.

- Prepare for Interviews: Practice common interview questions, research the company, and be ready to discuss your experiences and goals in the finance industry.

Career Progression and Advancement

As financial analysts gain experience and expertise in their field, they have the opportunity to progress to more senior positions within the finance industry. Advancement in this career path is often driven by a combination of performance, networking, and continuous education.

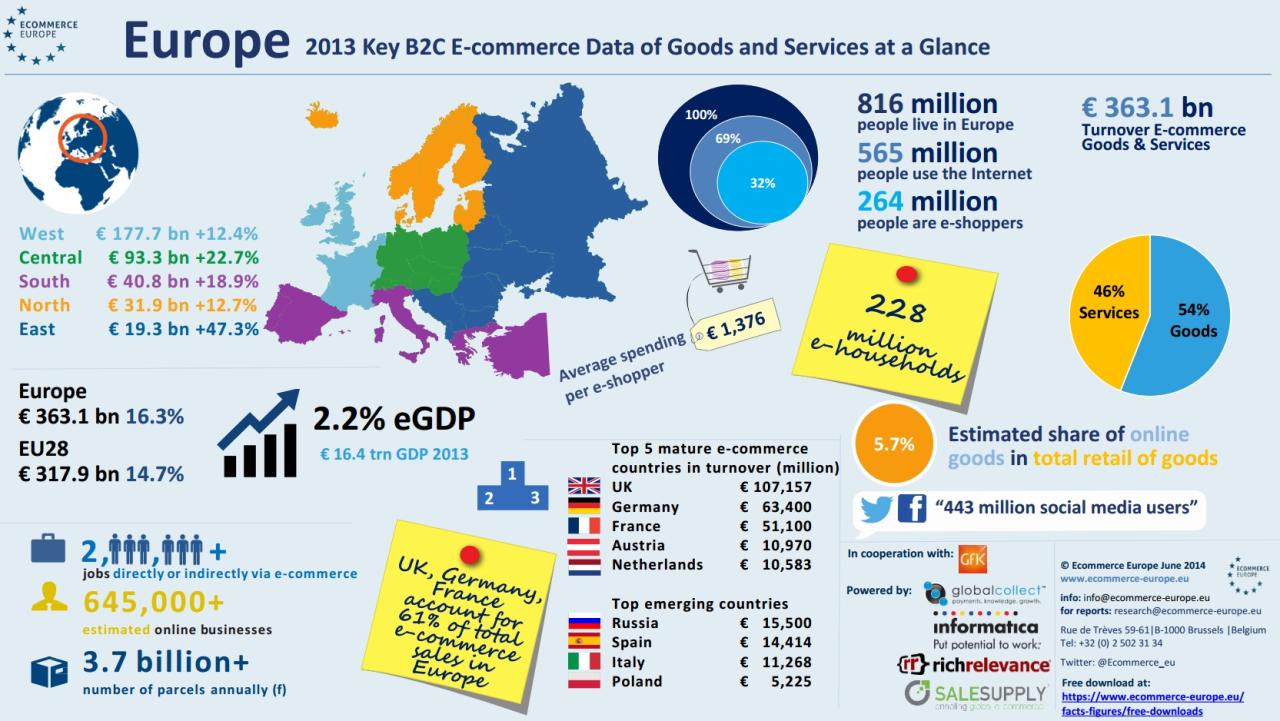

Typical Career Progression

Financial analysts typically start in entry-level positions where they focus on analyzing financial data, preparing reports, and assisting with financial modeling. As they gain experience, they may move on to roles such as senior financial analyst, financial manager, or investment analyst.

Senior financial analysts are often responsible for overseeing the work of junior analysts, making strategic financial decisions, and providing financial guidance to senior management.

Opportunities for Advancement

- Senior Financial Analyst: These professionals are responsible for more complex financial analysis, forecasting, and decision-making. They may also have the opportunity to lead projects and teams.

- Financial Manager: Financial managers are in charge of the overall financial health of an organization. They oversee financial reports, investment activities, and develop strategies to achieve long-term financial goals.

- Chief Financial Officer (CFO): The highest-ranking financial position within a company, the CFO is responsible for financial planning, record-keeping, and financial reporting. They play a crucial role in shaping the financial future of the organization.

Networking and Continuing Education

Networking plays a vital role in advancing a career as a financial analyst. Building relationships with industry professionals, attending networking events, and joining professional organizations can open up new opportunities for career growth. Continuing education, such as obtaining advanced degrees, certifications, or attending workshops, can also enhance a financial analyst's skill set and make them more competitive in the job market.

Specializations and Industry Trends

In the field of financial analysis, professionals often choose to specialize in specific areas to further their expertise and career opportunities. Additionally, staying informed about industry trends is crucial for success in this dynamic field.

Investment Banking

Investment banking is a popular specialization for financial analysts who are interested in working with mergers and acquisitions, raising capital, and providing financial advisory services to corporations and institutional investors. Analysts in this field often work long hours and must possess strong analytical skills to evaluate complex financial transactions.

Risk Management

Risk management is another specialization within financial analysis that focuses on identifying, assessing, and mitigating potential risks that could impact an organization's financial performance. Financial analysts specializing in risk management often work closely with other departments to develop strategies for managing risks related to market fluctuations, regulatory changes, and operational challenges.

Corporate Finance

Corporate finance is a specialization that involves analyzing financial data to help companies make strategic decisions related to investments, capital budgeting, and financial planning. Financial analysts specializing in corporate finance often work closely with executives to develop financial models, evaluate investment opportunities, and assess the financial health of the organization.

Industry Trends

Staying updated on industry trends is essential for financial analysts to remain competitive and relevant in their field. Some current trends shaping the role of financial analysts include the increasing use of data analytics and artificial intelligence in financial decision-making, the rise of sustainable and impact investing, and the growing importance of cybersecurity in protecting financial data.

Data Analytics and Artificial Intelligence

The integration of data analytics and artificial intelligence tools in financial analysis has revolutionized the way analysts interpret and analyze financial data. Financial analysts who are proficient in using these technologies are better equipped to make data-driven decisions and provide valuable insights to their organizations.

Sustainable and Impact Investing

With a growing emphasis on environmental, social, and governance (ESG) factors in investment decisions, financial analysts are increasingly focusing on sustainable and impact investing strategies. Analysts who specialize in this area help investors identify opportunities that align with their values and contribute to positive social and environmental outcomes.

Cybersecurity

As financial transactions and data are increasingly digitized, cybersecurity has become a top priority for financial institutions. Financial analysts play a critical role in assessing and mitigating cybersecurity risks to protect sensitive financial information and maintain the trust of clients and stakeholders.

Ending Remarks

As we conclude our exploration of the financial analyst career path, it becomes evident that this journey is filled with possibilities for growth and success. By staying informed, honing your skills, and seizing opportunities, you can pave a rewarding path in the world of finance as a financial analyst.

Questions Often Asked

What are the key responsibilities of a financial analyst?

Financial analysts are responsible for assessing financial data, creating financial models, and providing insights to guide investment decisions.

How important is networking for career advancement in financial analysis?

Networking plays a crucial role in career advancement for financial analysts, as it can lead to new opportunities, mentorship, and industry insights.

What are some common specializations within financial analysis?

Common specializations include investment banking, risk management, and corporate finance, each offering unique challenges and opportunities for growth.